Also take into account how your residence taxes may possibly alter that has a new household purchase. To determine, figure out your neighborhood residence tax fee and multiply by your property buy value.

We also take into consideration regulatory steps submitted by businesses like The buyer Economic Security Bureau. We weigh these things based on our evaluation of which happen to be The key to individuals And exactly how meaningfully they impression buyers’ encounters.

A lot of customer loans slide into this category of loans that have frequent payments which might be amortized uniformly more than their life span. Plan payments are created on principal and fascination right until the loan reaches maturity (is completely paid out off). A few of the most familiar amortized loans incorporate mortgages, auto loans, college student loans, and private loans.

Upgrade provides particular loans starting at $1,000 to borrowers with low credit score scores. The lender gives credit-making resources and rate discounts which make it a sound choice for Those people aiming to Make credit history.

Capital—refers to some other assets borrowers could have, In addition to cash flow, that can be applied to fulfill a credit card debt obligation, such as a down payment, price savings, or investments

NerdWallet’s overview method evaluates and rates particular loan merchandise from over 35 money engineering corporations and financial establishments. We accumulate about fifty info factors and cross-Check out firm Sites, earnings studies together with other public files to confirm products specifics.

Month to month payments on a private loan are based on your loan sum, APR and repayment time period. Annual proportion fees often array in between 6% and 36%, and repayment phrases typically range from two to seven yrs.

Upstart gives particular loans beginning at $1,000 and claims it can fund most loans a person business enterprise day following a borrower signs a loan arrangement. This lender works by using alternate data to assist borrowers with honest credit score and those with slim credit history histories qualify.

Unsecured loans generally attribute increased fascination fees, lower borrowing limits, and shorter repayment conditions than secured loans. Lenders may perhaps often need a co-signer (a one who agrees to pay for a borrower's debt should they default) for unsecured loans When the lender deems the borrower as risky.

A number of the nation’s biggest banking institutions supply tiny-dollar loans to its existing customers. These loans usually have shorter repayment phrases than classic personal loans. Here are a few illustrations:

A lot of professional loans or short-term loans are in this category. Unlike the first calculation, that's amortized with payments distribute uniformly about their lifetimes, these loans have one, large lump sum thanks at maturity.

Collateral—only relates to secured loans. Collateral refers to one thing pledged as stability for repayment of a loan in the event that the borrower defaults

A loan expression may be the period with the loan, given that required least payments are created monthly. The term of your loan can influence the structure of your loan in some ways.

This conflict of fascination influences our power to give you impartial, aim specifics of the services of Atomic Spend. This may suggest the solutions of A further expense adviser with whom we are not engaged may very well be additional appropriate for you than Atomic Commit. Advisory companies by way of Atomic Devote are designed to help shoppers in achieving a favorable end result within their investment decision portfolio. They don't seem to be intended to offer tax guidance or economical arranging with respect to each facet of a consumer’s economical predicament and do not include things like investments that clientele here may well maintain beyond Atomic Invest. For more information about Atomic Devote, be sure to see the Form CRS, Variety ADV Element 2A, the Privacy Policy, together with other disclosures.

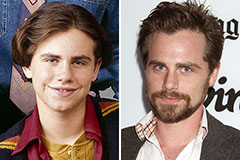

Rider Strong Then & Now!

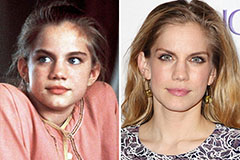

Rider Strong Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!